Money freedom is very important in today’s world, so digital nomads need to find smart ways to manage their money. That’s where Venmo steps in. It’s a well-known payment app that has revolutionized peer-to-peer transfers.

Do you need a bank account for Venmo? This blog explores that question and offers insights and tips for digital nomads looking to optimize their financial transactions.

What is Venmo, and how does it work?

Venmo is a mobile payment service owned by PayPal. It allows users to transfer money to others using a mobile phone app. Venmo is known for its social features, where transactions can be shared on a social feed. This makes it not only a financial tool but also a social experience.

How Venmo Compares to Other Payment Apps

When compared to other payment apps like PayPal and Cash App, Venmo is known for its simple user interface and unique social feed feature. PayPal is known for its focus on business transactions, while Cash App provides investment options. On the other hand, Venmo stands out for its social aspect and its ability to facilitate peer-to-peer transactions.

What are the special features of Venmo?

Social Payments

One thing that makes Venmo really fun is its social payment system. You can include friends, split funds, and even like or comment on transactions. This social element not only makes handling money more enjoyable but also helps users connect with each other.

Receiving Funds

Receiving money on Venmo is super easy. Once someone sends you cash, it pops up in your Venmo balance. You can use it for future transactions or transfer it to your bank account.

Security Measures

Venmo prioritizes the security of its users by implementing robust encryption and vigilant monitoring to safeguard their information. Users can enable two-factor authentication for an extra layer of security.

What do I need to open a Venmo account?

To get started with a Venmo account, you’ll need some basic info like your name, email, and phone number. You might also need to confirm your identity with a government-issued ID. Simple as that!

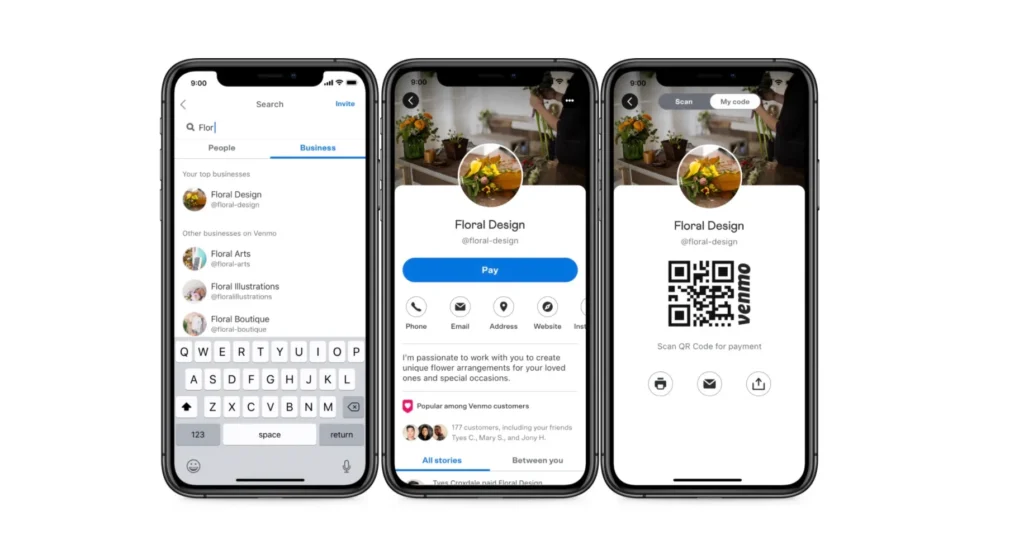

How to link a bank account to Venmo?

Take a look at this guide to help you add a bank account to your Venmo profile.

To add a bank account to your Venmo profile from your computer, just click here and choose “Link Bank Account“. Then, simply follow the steps on the page.

How to add a bank account using the Venmo app:

- Head over to the “Me” tab by tapping your picture or initials.

- Navigate to the Wallet section.

- Tap on “Add a bank or card…” and choose “Bank“.

- Pick your favorite verification method.

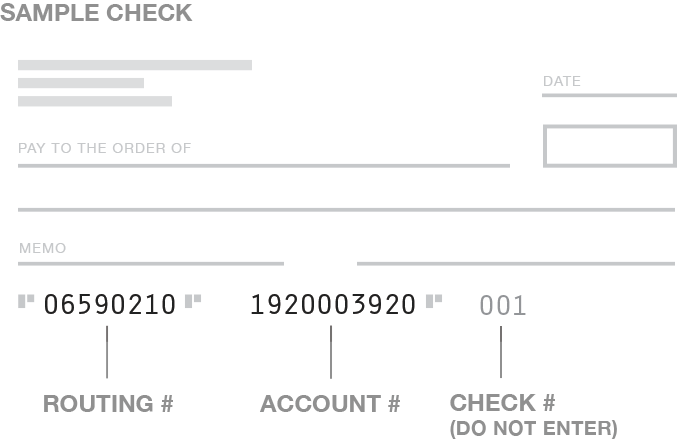

Take a look at this image to help you find the account and routing numbers for your bank account:

Can you use Venmo balance and debit card?

Absolutely! Venmo gives you the convenience of using both your Venmo balance and a debit card to make payments.

Balance on Venmo

When you have sufficient funds in your account, Venmo will automatically use your balance to cover the full payment amount. You have the option to utilize your balance for payments to other Venmo users or merchants who accept Venmo.

However, it is not possible to withdraw cash or transfer funds to a bank account. Using your Venmo balance to make payments is completely fee-free. You can easily use your balance by selecting it as your payment method when making a purchase in the Venmo app or website.

Debit card

You have the option to link a debit card to your Venmo account, allowing you to conveniently make payments. If your balance is insufficient to cover the payment, Venmo will charge the full cost to your preferred payment method.

Manage your payment methods easily in the Payment Methods section of your Venmo account settings.

How to Add Money to Your Venmo Balance

You can easily add money to your Venmo balance right in the app. Just head to the Me tab and tap Add Money. Here’s how:

- Choose from your bank or debit card

- Enter the amount and select your funding source

- Tap Add

Once you’ve done this, keep in mind that the transfer can’t be canceled.

Do you need a bank account for Venmo?

Is a bank account necessary for Venmo? The short answer is no, but there are a few limitations. You can still use Venmo by linking a credit or debit card or receiving funds directly into your Venmo balance.

How to Receive Money in Venmo

Receiving money in Venmo is easy – all you have to do is ensure your account is set up and ready to accept funds. There is no need to take any additional steps! Whenever someone sends you money, it will conveniently and seamlessly appear in your Venmo balance.

Here’s a simple guide that breaks down the process into easy-to-follow steps:

- Share Your Username or Scan Code: share your Venmo username or scan code with the person who will be sending you money. This ensures that users can easily locate and choose your profile within the app.

- Notification of Payment: After the payment is sent, you’ll receive a notification within the app to let you know that the new funds have arrived.

- Check Your Balance: Simply open the Venmo app and head over to the Me tab. Here, you can easily view your updated balance, which now includes the funds you received.

Receiving money in Venmo is incredibly user-friendly, ensuring a smooth and hassle-free experience. It’s the perfect tool for effortlessly managing peer-to-peer transactions with speed and efficiency.

What fees does Venmo charge?

Venmo charges fees for certain transactions, such as sending money using a credit card and instant transfers to your bank.

Regular transfers: There is no fee when you use your Venmo balance, bank account, or debit card. Just a heads up, there is a 3% fee for credit card payments.

Business payments: A small fee of 1.9% will be charged, along with a fixed amount of $0.10 for every payment received. The fees will be automatically deducted from the total payment amount sent by your customer.

Fees for Sending Money Using a Credit Card

There is a 3% fee that is applicable when you choose to send money using a credit card. On the bright side, there are no charges for sending money from your Venmo balance or linked bank account.

What is the instant fee limit on Venmo?

Instant transfers to your bank account come with a 1.75% fee, but don’t worry—there’s a minimum of just $0.25 and a maximum of $25.

Transaction Limits on Venmo

There are certain limits in place when it comes to sending and receiving money through Venmo, as well as withdrawing funds to your linked bank account:

Every day, unverified accounts can send and receive a maximum of $300, while verified accounts can enjoy a higher limit of up to $5,000.

Every week, unverified accounts can transfer a maximum of $500, whereas verified accounts have the privilege of transferring up to $60,000 per week. Nevertheless, Venmo’s security checks may result in lower caps for individual payments.

Accounts with limited verification can make transactions of up to $1,000 per month, while fully verified accounts have a higher monthly transaction limit of $20,000.

Is Venmo 100% safe?

Venmo provides multi-factor authentication to enhance security. Although Venmo has implemented security protocols, there are still loopholes in payment verification that scammers, fraudsters, and other crooks can exploit. Therefore, making payments on Venmo to individuals you are unfamiliar with and do not trust is not advisable.

FAQs

-

Who can see my Venmo balance?

By default, your privacy setting is set to Public, allowing anyone on the Internet to view your payments. You have the option to modify it for each transaction separately or adjust it for all transactions in the Settings.

-

Can I use Venmo abroad without a bank account?

Unfortunately, Venmo is limited to use within the United States and cannot be used for international transactions.

-

How Long Does It Take to Transfer Money from Venmo to a Prepaid Card?

Transfers to prepaid cards usually take 1-2 business days.

-

How Can I Increase My Venmo Limit Without a Bank Account?

Completing the necessary identity verification steps can greatly enhance your Venmo limit, regardless of whether or not you have a linked bank account. This process guarantees improved security and enables you to conduct larger transactions, providing you with greater flexibility and convenience in managing your finances.

-

Which is safer, PayPal or Venmo?

You must know PayPal and Venmo’s security procedures to compare their safety. Both sites are owned by PayPal Holdings, Inc., which employs robust security protocols. Most consumers say PayPal is safer because of its buyer and seller protections, encryption, and two-factor authentication. These features protect user data and actions.

Due to its fewer buyer and seller protections, Venmo is less safe for commercial transactions than PayPal, even if it employs encryption and privacy settings. So, PayPal is typically the best option for safer and more secure transactions, especially when buying from strangers or sending significant amounts.

Conclusion

Ultimately, using Venmo without a bank account is possible. However, connecting one brings added convenience and expands your transaction limits.

Understanding the ins and outs of Venmo can greatly simplify managing finances while traveling as a digital nomad. Sign up for Venmo today and discover its user-friendly features that can simplify your financial transactions.

You Might Also Like the following:

- How do I get Fortnite on the Nintendo Switch?

- Lenovo IdeaPad Flex 5i 14 Review (2024)

- MSI MPG321URX QD-OLED Gaming Monitor Review 2024

- Top 10 Best Mechanical Keyboards 2024

- Panasonic Toughbook 55 Mk3 Review – 2024

- What specs should you look for in a gaming PC?

- What Is the Best Chair for Sitting Long Hours?

- Do artists get paid from Spotify?